Bank Reconciliation

Matching mutable accounting data with immutable banking data to increase confidence in financial data

Bank Reconciliation (Accounting Accuracy Score) - Beta

Please note that Bank Reconciliation (a.k. Accounting Accuracy Score) is in open beta across all integration. We recommend getting in touch with our product and integration support team before using it in production.

Prerequisites

Bank reconciliation requires active banking and accounting connections.

Overview

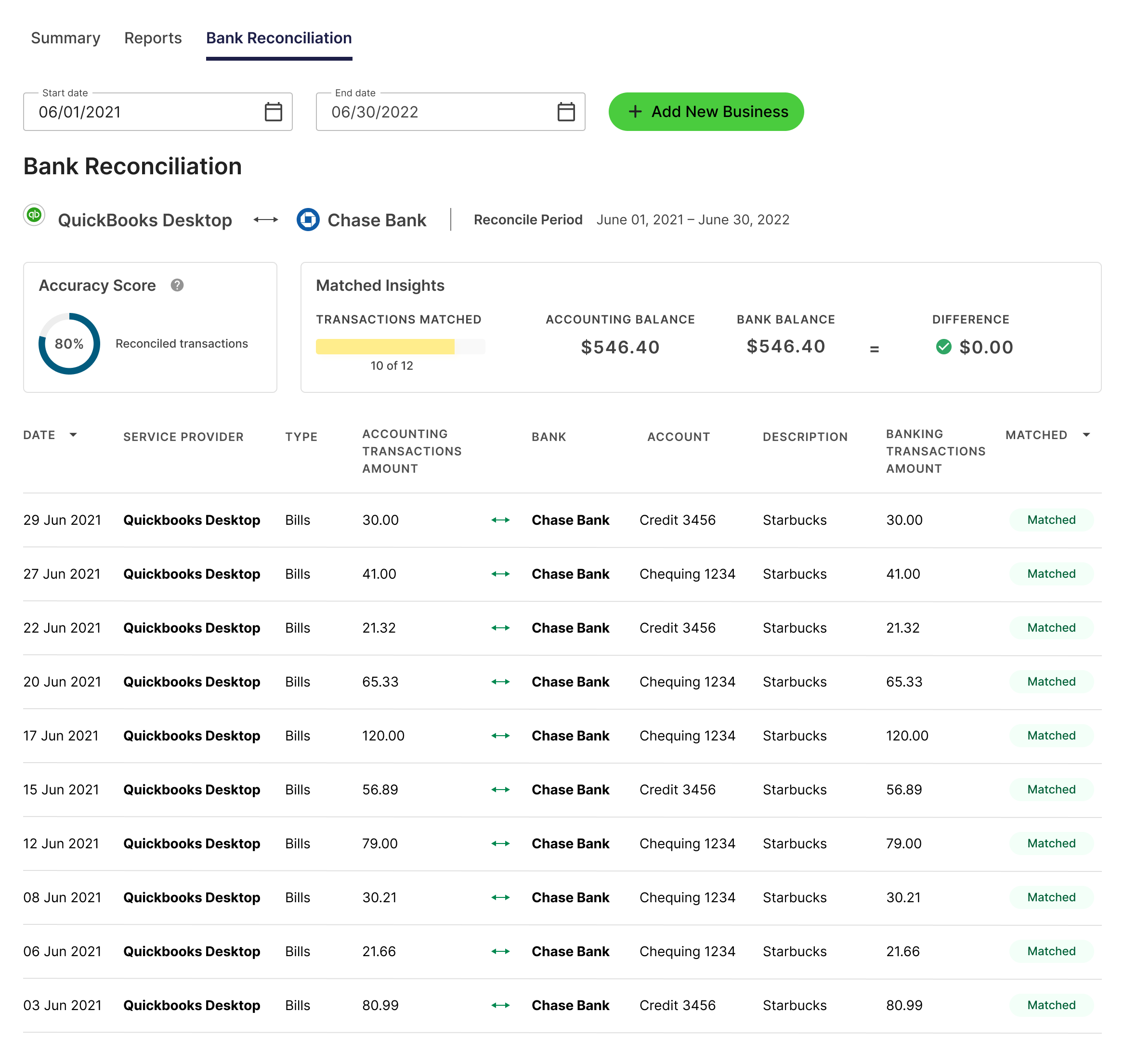

Our normalized accounting data gives our customers access to rich and transactional level data that helps them build great applications. Unlike bank data that comes directly from a trusted source through our banking integrations, accounting data is user-entered and mutable, which opens the door for fraud and misrepresentation. Our bank reconciliation (a.k.a accounting accuracy score) product automatically matches a business's bank transactions to their accounting records and most importantly, highlights non-matching ones so you don't have to spend hours performing manual reconciliation.

Bank reconciliation is an integral task to the accuracy of a business's financial data to ensure no potentially risky behaviour slips through the cracks. The accuracy of accounting data also lends itself to increasing our confidence in forecasts, fraud metrics and other analytics and insights.

How it Works?

Bank reconciliation is based on matching bank transactions of a given business in a specific month using the accounting transactions for the same business in that month. The reconciliation logic is a rule-based one-to-one match between accounting and banking transactions.

The transaction data used to reconcile the data sets is:

- Transaction amount

- Posted date

- Transaction type (rule-based)

- Exclusion of split accounting transactions in case of multiple matches

Through the Dashboard or /bankReconciliation endpoint, you can access a mixture of a banking accuracy score and descriptive statistics concerning the above reconciliation. The banking accuracy score quantifies the precision level of reconciliation by taking into account the number of matched transactions and the value of these transactions.

Accounting Data as a Service™ Analytics - Bank Reconciliation & Accounting Accuracy Score. Click to Expand.

Multi Currency

The initial version of our reconciliation doesn't support bank accounts with different currencies. We plan to support this in future releases.

See the Bank Reconciliation data model along with the API documentation for more details.

Updated over 1 year ago