Credit Score & Rating

A new way to get a credit score for your small or medium businesses

Overview

Small and medium enterprises (SMEs) trying to access financial products, such as loans, are required to submit FICO scores of the individual business owners. Since a traditional credit score doesn’t take into account assets, accounts receivable, vendor risk, or expenses it only offers a sliver of information and is centred around the individual, rather than the business itself. The individual owner of a business is not often a great reflection of a business’s financial health.

At Accounting Data as a Service™, we believe traditional credit scores have a very limited view of the overall financial health, purchasing power, and payment histories of a business. Our credit score & rating product provides a modern way for small and medium enterprises to get an appropriate and accurate credit score to help them get the financial product they need to support their business:

- Financial institutions can embed our credit score into their models and decision engine to get additional parameters on their SMEs based on alternative financial data.

- FinTech companies with no in-house capabilities to calculate credit scores or build decision engines can now utilize the Accounting Data as a Service™ Credit score to build their credit models.

How it Works?

Our Accounting Data as a Service™ Credit score is based on proprietary models that rely on a business’s financial statements to calculate the probability of default at a point in time and outputs a credit score and rating based on this information.

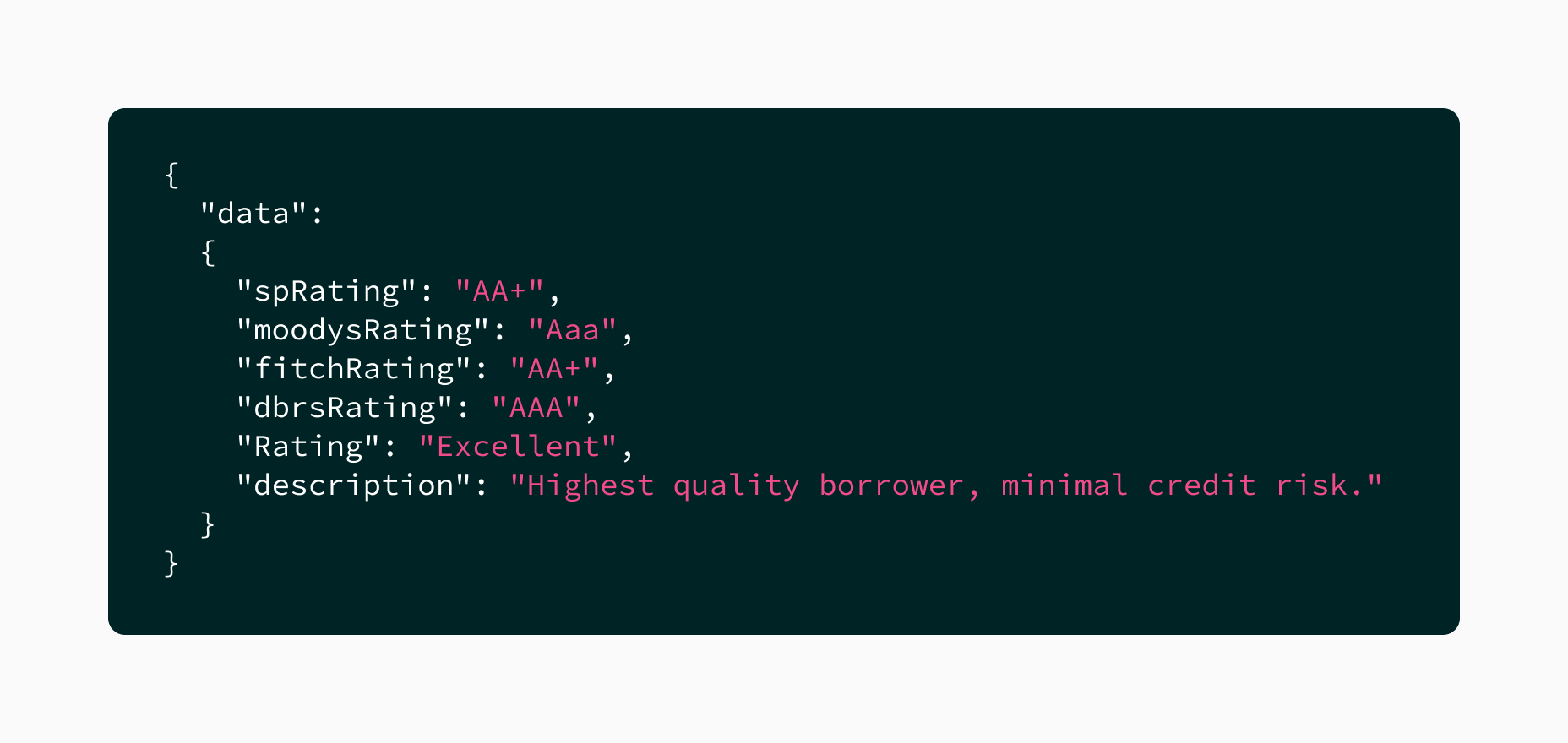

The /creditScores and /creditRatings endpoints, allow our financial institutions and FinTech customers to access the credit score and rating for their SME customers. In addition, our customers will be able to access equivalent SME ratings based on the big 4 US credit agencies, which is usually only available to public companies and larger organizations:

Accounting Data as a Service™ Credit Score & Rating sample response. Click to Expand.

See the Credit Scores and Credit Ratings data models along with the API documentation for more details.

Missing Credit Score?

A missing financial statement for a reporting period (e.g. due to no cashflow activity during that period), will result in a missing credit score & rating.

Updated over 1 year ago