Lending & Underwriting

Overview

By utilizing the Accounting Data as a Service™ API and following the guidelines outlined in this guide, lenders will be able to seamlessly integrate financial data into their application logic, enabling them to make informed credit decisions, perform analysis, and monitor the financial health of businesses more effectively.

- Financial Data Analysis: Retrieve balance sheet, income statement, and financial forecast data to assess the overall financial health of a business.

- Cash Flow Management: Access cash flow statements to evaluate a business's liquidity and cash flow management.

- Risk Assessment and Creditworthiness: Obtain a business credit score and risk assessment report for informed credit decisions.

- Customer Insights: Access customer data to gain insights into financial behavior and creditworthiness.

- Vendor Analysis: Retrieve vendor data to assess payment practices and supply chain risks.

Welcome to the Accounting Data as a Service™ API Guide for lenders in the financial industry. This guide aims to help you streamline your Accounting Data as a Service™ API setup so you can start helping your SMB clients with credit approval and monitoring processes, automate loan origination and servicing, and gain real-time visibility into loan status and performance using the Accounting Data as a Service™ API. By integrating our financial data solutions into your applications, you can make fast, informed decisions about the creditworthiness of your SMB clients.

Why Accounting Data as a Service™?

Accounting Data as a Service™ provides companies with the tools to make fast, strong, calculated decisions about the creditworthiness of businesses. The solution includes optimizing the credit approval and monitoring process, streamlining the loan origination and servicing process, and providing real-time visibility into loan status and performance.

Using the Accounting Data as a Service™ API in your lending operations can be used in seemingly endless use-cases, here are a few that you can start utilizing today:

- Streamline SMBs' credit approval and monitoring process with real-time financial statements, credit insights, and financial ratios.

- Digitize and automate the loan origination and servicing process, including loan application, credit checks, and record keeping, while reducing manual effort, errors, and regulatory risk.

- Automate loan reconciliation and delinquency management to provide lenders with real-time visibility into loan status and performance, improve portfolio management, reduce costs, and enhance borrower satisfaction.

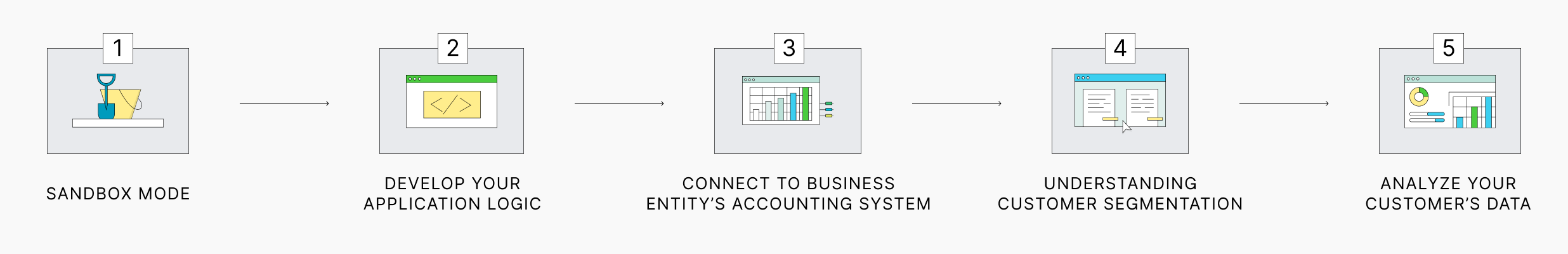

The Approach to Achieve Success

To achieve the objectives mentioned above, follow these steps:

- Sandbox Mode: Use Sandbox Mode to observe and understand the reports provided by the Accounting Data as a Service™ API. Explore our endpoints and financial ratios to understand what data will serve your underwriting best.

- Develop Your Application Logic: Integrate with the relevant endpoints to obtain financial information for credit decisioning, analysis, and monitoring as part of your application or loan management process.

- Connect to Business Entity's Accounting Service Provider Using Accounting Data as a Service™ Connect: This enables you to access the financial data necessary to assess the entity's financial health.

- Understand Customer Segmentation with Accounting Data as a Service™ API: Utilize Accounting Data as a Service™ API to gain insights into customer segmentation. Analyze customer data, including demographics, transaction history, and financial ratios, to better understand and segment your customer base.

- Analyze Your Customers' Data: Utilize Accounting Data as a Service™ Dashboard to easily visualize reports and data. Additionally, you can leverage the Reports and Visualization SDK to create customized visualizations of financial data fetched from the API endpoints, enhancing your loan origination, servicing, or monitoring applications.

Understanding the Data & Endpoints

The Accounting Data as a Service™API offers various endpoints that provide crucial financial data for credit decisioning, analysis, and monitoring. Here are some commonly used endpoints:

Integrate with these endpoints to obtain financial information that can assist in your underwriting process.

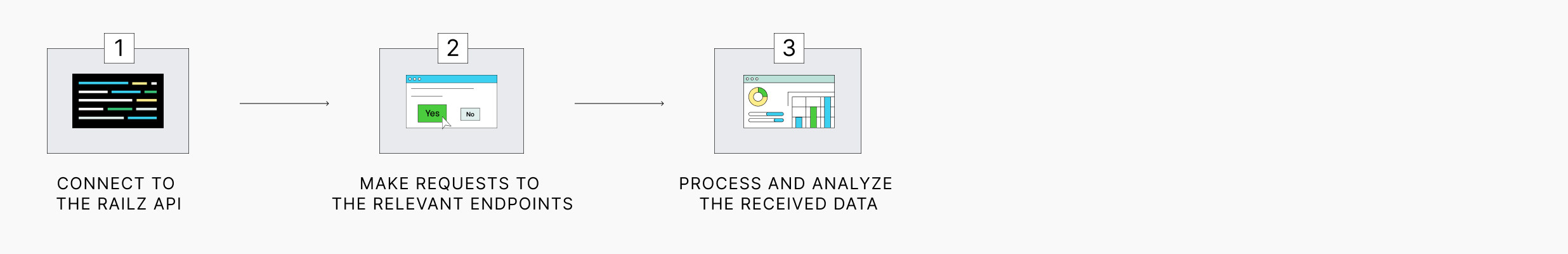

Integration & Application Logic

Integrate the Accounting Data as a Service™ API endpoints into your application logic to obtain financial information for credit decisioning, analysis, and monitoring. This integration will automate and optimize your loan origination and servicing processes. Use the following steps as a guide:

- Connect to the Accounting Data as a Service™API and authenticate your requests.

- Make requests to the relevant endpoints to retrieve financial data, such as balance sheets, income statements, credit scores, financial ratios, and more.

- Process and analyze the received data to make informed credit decisions and monitor the financial health of businesses.

Customer Onboarding

Onboard your customers using Accounting Data as a Service™ Connect for a more integrated solution. These tools seamlessly integrate with your application as you onboard, service, and monitor your loans. Choose the option that best suits your requirements and provides a smooth onboarding experience for your customers. It's time to onboard your first customer!

Data Analysis & Visualization

Accounting Data as a Service™ provides powerful tools for data analysis and visualization, empowering lenders to gain actionable insights from financial data. You have two options:

- Accounting Data as a Service™ Dashboard: Easily visualize reports and data. Utilize the intuitive interface to analyze financial information and make informed decisions.

- Reports and Visualization SDK: Leverage the Reports and Visualization SDK to create customized visualizations of financial data fetched from the Accounting Data as a Service™ API endpoints. This enables you to enhance your loan origination, servicing, or monitoring applications with tailored visualizations.

Expected Outcomes

By leveraging the Accounting Data as a Service™ API in your lending operations, you can expect the following outcomes:

- Assess the financial health of small businesses effectively.

- Automate the loan underwriting process, saving time and reducing errors.

- Access Accounting Data as a Service™ advanced risk management technology, including fraud risk metrics, probability of default calculations, and financial benchmarking.

- Improve loan performance and reduce risk exposure.

- Enhance loan management throughout the duration of the loan.

- Identify new revenue opportunities.

- Comply with regulations.

Congratulations!

You now have a comprehensive understanding of how to leverage the Accounting Data as a Service™ API to streamline credit approval and monitoring processes, automate loan origination and servicing, and gain real-time visibility into loan status and performance. By integrating Accounting Data as a Service™ financial data solutions into your lending operations, you'll be equipped to make fast, informed decisions about the creditworthiness of businesses, improving efficiency, reducing risk, and enhancing borrower satisfaction.

Don't Hesitate to Reach out

If you require additional assistance you can:

- Reference our help centre HERE

- Or click the chat bubble in the bottom right corner of this page to start a conversation with our support team

Updated 10 months ago