Probability of Default

Overview

The credit quality of a business is essential information that reflects an entity’s financial health and its ability to meet debt obligations. Credit quality can be expressed as a credit score, but it is most explicit when expressed as a probability of default. These probabilities have many uses in finance — from meeting regulatory requirements to loan origination to portfolio construction.

How it Works?

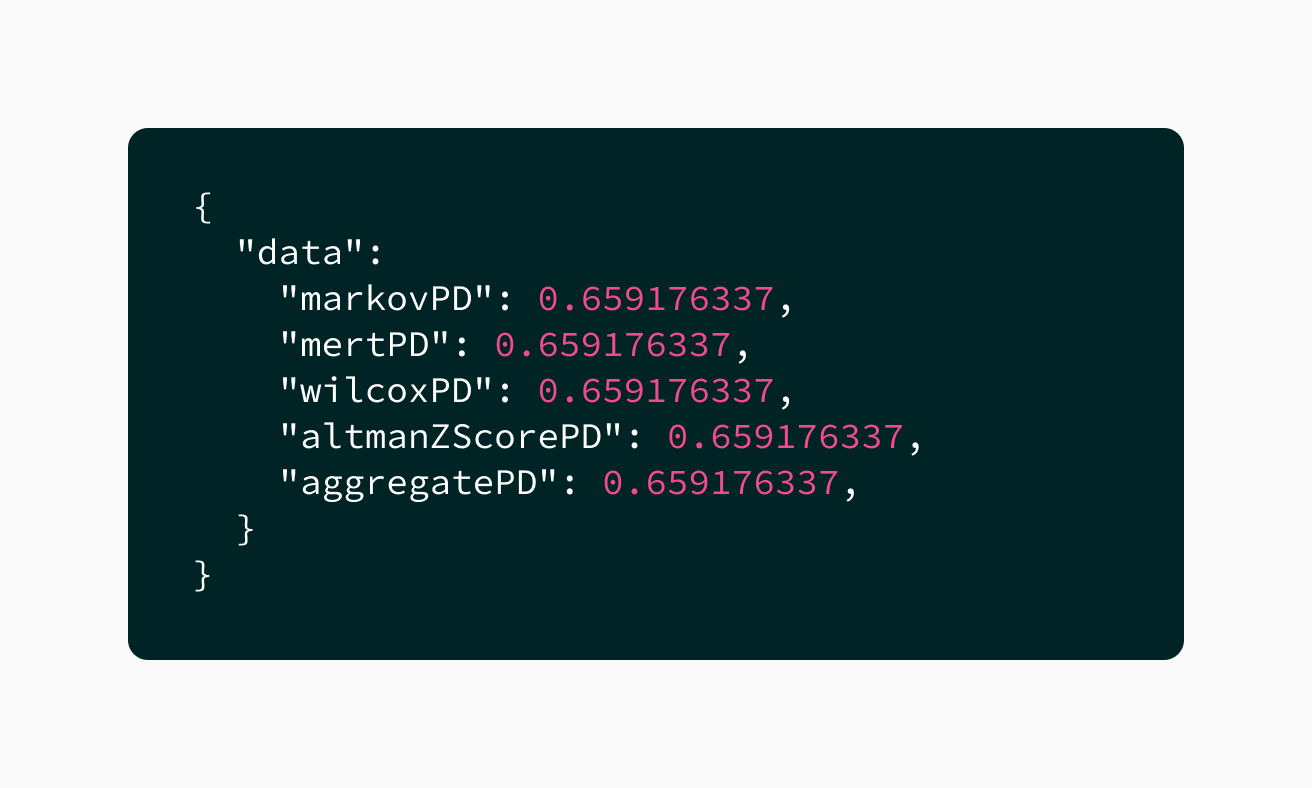

Our probability of default (PD) calculation considers multiple definitions of default based on a 1-year Point-in-Time PD. We have created a PD model for each definition and constructed an aggregate PD model that is available to you through the /probabilityOfDefault endpoint.

With PD, you will underwrite your business customers faster, easily monitor their ongoing health, and provide improved financial reporting, planning and analysis. You will have more confidence in your decisions knowing they are based on up-to-date and accurate data.

Definitions of Default

Accounting Data as a Service™ considers the following definitions of default

Days Past Due

Default is often not instantaneous and happens over a period of time when payables become increasingly delinquent. Delinquent payable accounts are grouped into 30-day buckets of increasing delinquency: current, 1-30 days past due, 31-60 days past due, 61-90 days past due and 91+ days past due. A terminating state is designated as the default state, typically 91+ days past due is considered a default.

Balance Sheet Default

Default occurs when the business' debts outsize its assets, and therefore the continued operation of the business is no longer considered worthwhile. On the balance sheet, this occurs when the face value of the debt of the business is greater than the value of its assets. That is when the equity of the firm is negative. Our team uses the Merton Model to calculate PD based on our normalized balance sheet of a business.

Cash Flow Default

Default occurs when cash inflows from revenue and the sale of assets are insufficient to make payments on debts. To calculate this we use Wilcox’s Model which takes a cash flow view of default.

Insolvency

Simply put, firms are considered either solvent (not in default), or solvent (in default). Our team uses Altman’s Z-score to calculate this based on our normalized financial data.

Probability of default sample response. Click to Expand.

See the Probability of Default data model along with the API documentation for more details.

Missing Probability of Default?

A missing financial statement for a reporting period (e.g. due to no cashflow activity during that period), will result in a missing probability of default.

Updated over 1 year ago