Fraud Risk Metrics

Overview

Detecting anomalous financial activity is a powerful way to discover insider threat activities. Our fraud risk metrics leverage Benford's law to detect financial fraud in a business's financial statements and ratios. Benford’s law is a statistical tool that can flag anomalies and discrepancies in a transaction data set to detect interventions or compromises that undermine a data set’s integrity. Data manipulated for tax evasion, loan underwriting or other fraudulent purposes will likely deviate from Benford’s law.

How it Works?

Financial statement fraud can take multiple forms, including:

- Overstating revenues by recording future expected sales

- Inflating an asset's net worth by knowingly failing to apply an appropriate depreciation schedule

- Hiding obligations and/or liabilities from a company's balance sheet

- Incorrectly disclosing related-party transactions and structured finance deals

Through the /financialFraudRisk endpoint, you will be able to access a score and metrics that indicate potential fraud. Our fraud risk metrics will help you detect if your business customers have done any sort of manipulation with their earnings or financials.

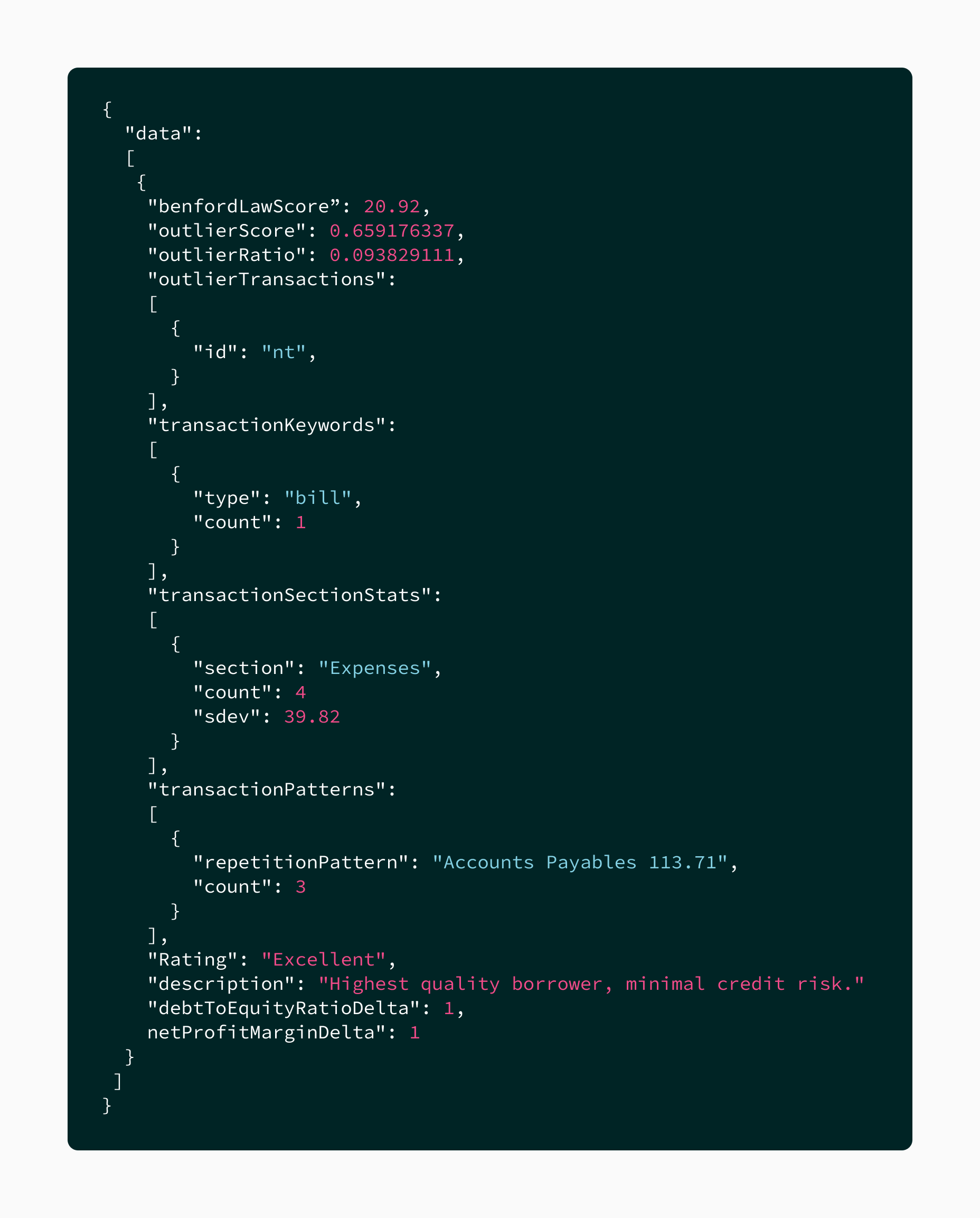

Fraud risk metrics sample response. Click to Expand.

See the Fraud Risk Metrics data model along with the API documentation for more details.

Updated over 1 year ago