Business Financial Planning & Analysis

Overview

By integrating these Accounting Data as a Service™ endpoints, financial institutions can enhance their understanding of SMBs' financial profiles, improve credit assessments, provide valuable financial insights, and facilitate seamless banking transitions for their customers.

- Financial Insights: Obtain financial statements, ratios, and reports through endpoints to gain comprehensive insights into the financial health and performance of SMBs.

- Cash Flow Forecasting: Leverage financial forecast endpoints to access robust and normalized data sets for accurate cash flow forecasting and liquidity management.

- Business Credit Assessment: Utilize Credit Score endpoints to provide a holistic view of SMBs' financial health and enable better credit decision-making.

- Seamless Banking Transitions: Leverage endpoints to facilitate smooth and quick transitions to new banks by providing relevant customer payment information.

Accounting Data as a Service™ API provides financial institutions with a comprehensive set of tools to better understand the financial health of their SMB customers and offer tailored financial management solutions. This guide will walk you through the steps to integrate Accounting Data as a Service™ API into your application and leverage its endpoints to gain valuable insights into your customers' businesses.

Why Accounting Data as a Service™?

The objective of this guide is to help financial institutions improve their business financial management capabilities by utilizing Accounting Data as a Service™ API. The key objectives are as follows:

- Provide a business credit score and holistic view of SMBs' financial health to enhance customer understanding and enable better financial advice.

- Utilize robust, normalized data sets for cash flow forecasting to assist customers in planning and preparation.

- Streamline banking transitions by enabling a smooth transfer of customer information and understanding payment patterns.

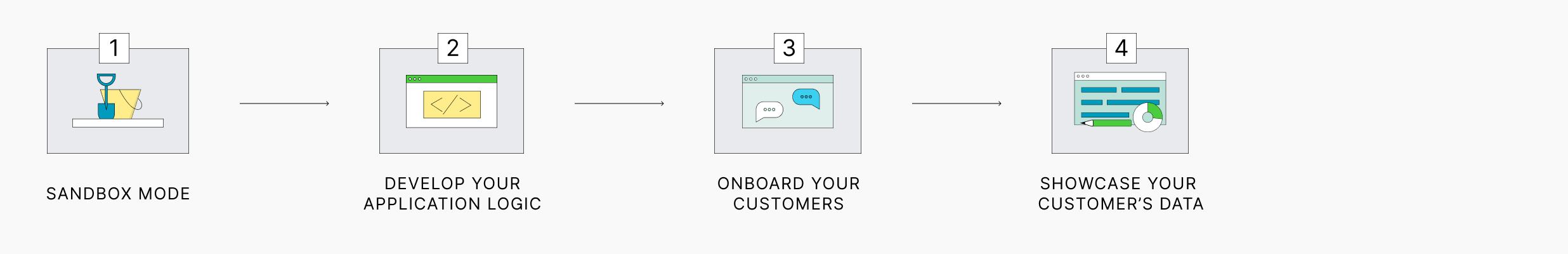

The Approach to Achieve Success

Follow these steps to integrate Accounting Data as a Service™ API and leverage its capabilities for effective business financial management:

- Sandbox Mode:Begin by exploring Sandbox Mode, which allows you to observe and understand the reports provided by FIS Accounting Data as a Service™. Familiarize yourself with the API endpoints and test the relevant reports for your specific use case.

- Develop your Application Logic: Integrate the chosen endpoints into your application logic to obtain essential financial statements, ratios, forecasts, and other analytics. This integration will enable you to embed these insights within your application's interface or backend.

- Onboard your Customers: Onboard your customers using Connect for a more custom solution. These tools seamlessly integrate with your application, simplifying the onboarding process for your customers.

- Showcase Your Customers' Data: Leverage the Reports and Visualization SDK to present financial charts, objects, and graphs to your customers. Alternatively, use the Accounting Data as a Service™ API to obtain financial statements, ratios, forecasts, and other analytics that empower your customers to operate their businesses more effectively.

Understanding the Data & Endpoints

To support your business financial management objectives, consider utilizing the following commonly used endpoints provided by Accounting Data as a Service™ API:

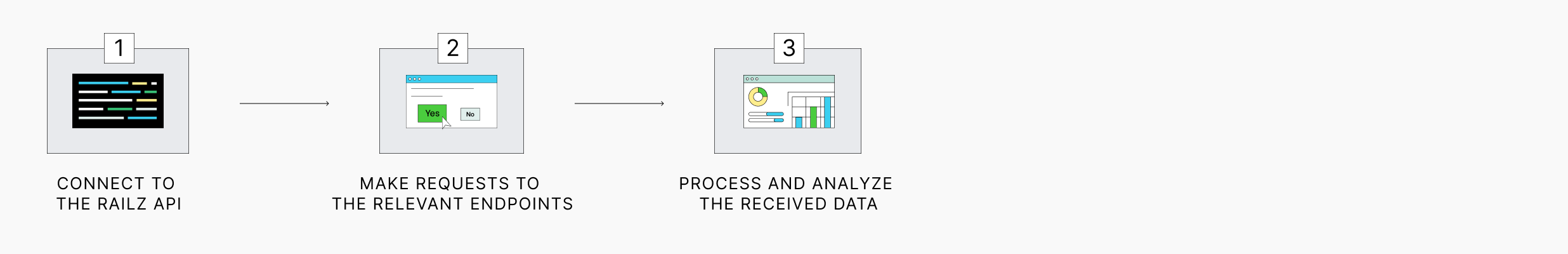

Integration & Application Logic

Integrate the Accounting Data as a Service™ API endpoints into your application logic to automate and optimize your business financial management processes. By leveraging the API, you can efficiently access and analyze financial data, including balance sheets, income statements, credit scores, and financial ratios, to gain a holistic view of SMBs' financial health. Use the following steps as a guide:

- Connect to the API and authenticate your requests.

- Make requests to the relevant endpoints to retrieve financial data, such as balance sheets, income statements, credit scores, financial ratios, and more.

- Process and analyze the received data to make informed credit decisions and monitor the financial health of businesses.

Customer Onboarding

Onboard your customers using Accounting Data as a Service™ Connect for a more integrated solution. These tools seamlessly integrate with your application as you onboard, service, and monitor your loans. Choose the option that best suits your requirements and provides a smooth onboarding experience for your customers. It's time to onboard your first customer!

Data Analysis & Visualization

Accounting Data as a Service™ provides powerful tools for data analysis and visualization, empowering lenders to gain actionable insights from financial data. You have two options:

- FIS Accounting Data as a Service™ Dashboard: Easily visualize reports and data. Utilize the intuitive interface to analyze financial information and make informed decisions.

- Reports and Visualization SDK: Leverage the Reports and Visualization SDK to create customized visualizations of financial data fetched from the Accounting Data as a Service™ API endpoints.

Expected Outcomes

By leveraging Accounting Data as a Service™ API for business financial management, financial institutions can expect the following outcomes:

- Automation of manual financial processes: Streamline and automate previously manual financial processes to improve efficiency and reduce errors.

- Access to real-time data insights: Gain access to real-time financial data and insights, enabling better decision-making and risk management.

- Integration with existing internal software: Seamlessly integrate Accounting Data as a Service™ API with your existing company software to leverage its capabilities without disruptions.

- Scalability to handle increasing data and clients: Scale your financial management capabilities to handle growing volumes of data and an expanding client base.

- Effective assessment and management of risks: Enhance your ability to assess and manage risks effectively by leveraging the advanced analytics and insights provided by Accounting Data as a Service™ API.

Congratulations!

By following this guide and integrating Accounting Data as a Service™ API into your business financial management processes, financial institutions can unlock new opportunities for growth, improve decision-making, and provide enhanced financial services to their SMB customers.

Don't Hesitate to Reach out

If you require additional assistance you can:

- Reference our help centre HERE

- Or click the chat bubble in the bottom right corner of this page to start a conversation with our support team

Updated over 1 year ago