Payment Reconciliation

Overview

By integrating these Accounting Data as a Service™ endpoints, financial institutions can automate payment reconciliation tasks, ensure data accuracy, and improve operational efficiency in managing financial transactions.

- Reconciliation Automation: Utilize vendor and bill endpoints to efficiently reconcile vendor and bill information for accurate payment reconciliation.

- Banking Transaction Matching: Leverage banking transaction endpoints to match and reconcile banking transactions with accounting data, ensuring accuracy in financial records.

- Merchant Transaction Reconciliation: Streamline merchant transaction reconciliation by leveraging endpoints that enable seamless matching of merchant transactions with sales transactions.

- Data Visualization: Utilize reports and visualization endpoints to present financial data and facilitate data-driven decision-making in payment reconciliation processes.

Welcome to the guide on leveraging Accounting Data as a Service™ API to automate payment reconciliation processes in the financial industry. This guide is designed to help financial institutions bring in data from their SMB customers and better understand various aspects of their customers' businesses. By integrating with Accounting Data as a Service™ API, you can streamline payment reconciliation tasks, reduce administrative burden, and improve operational efficiency.

Why Accounting Data as a Service™?

The objective of leveraging Accounting Data as a Service™ API for payment reconciliation is to automate and optimize the reconciliation processes, ensuring accurate and efficient handling of financial data. The specific objectives include:

- Automating the reconciliation of accounts receivable/payable by ingesting vendor and bill information and matching them with the accounting service provider data.

- Automating the reconciliation of banking transactions by pulling transaction data and reconciling it with accounting data.

- Automating the reconciliation of merchant transactions with sales transactions, improving accuracy and reducing discrepancies.

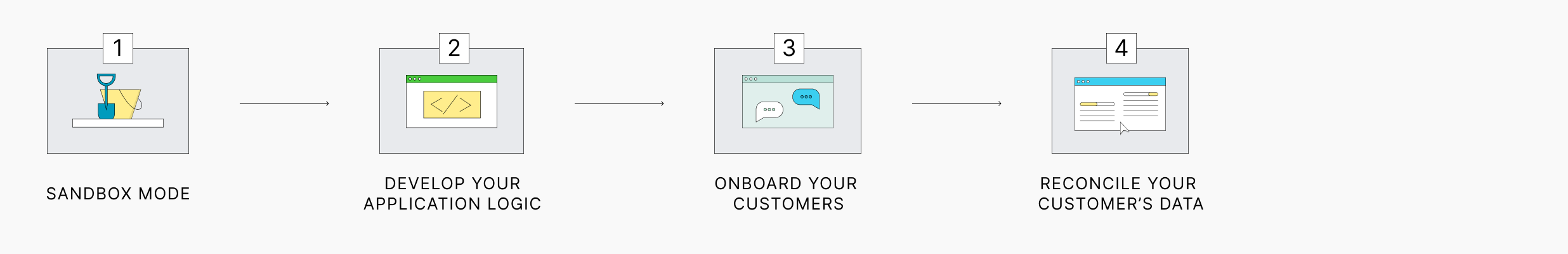

The Approach to Achieve Success

Follow these steps to implement payment reconciliation using the Accounting Data as a Service™ API:

- Sandbox Mode: Begin by using the Sandbox Mode to observe and understand the reports provided by Accounting Data as a Service™. Explore the Accounting Data as a Service™ API and test the commonly used endpoints relevant to your payment reconciliation use case.

- Develop your Application Logic: Integrate with the chosen endpoints to automate data processing and trigger appropriate actions. This includes pulling vendor information, bills, invoices, and other payment-related data. Design your application logic to handle data reconciliation and synchronization.

- Onboard your Customers: Onboard your customers using Accounting Data as a Service™ Connect for a more custom solution. These tools seamlessly integrate with your application, simplifying the onboarding process for your customers.

- Reconcile your Customer's Data: Utilize Accounting Data as a Service™ Reports and Visualization SDK to visualize data, such as vendor information, bills, and invoices fetched from the Accounting Data as a Service™ API. Use this information to push transactions against bills or invoices into an accounting service provider for reconciliation purposes.

Understanding the Data & Endpoints

To achieve payment reconciliation, the following endpoints are commonly used.

Refer to the Accounting Data as a Service™ API documentation for detailed information on these endpoints, including request/response structures and parameters.

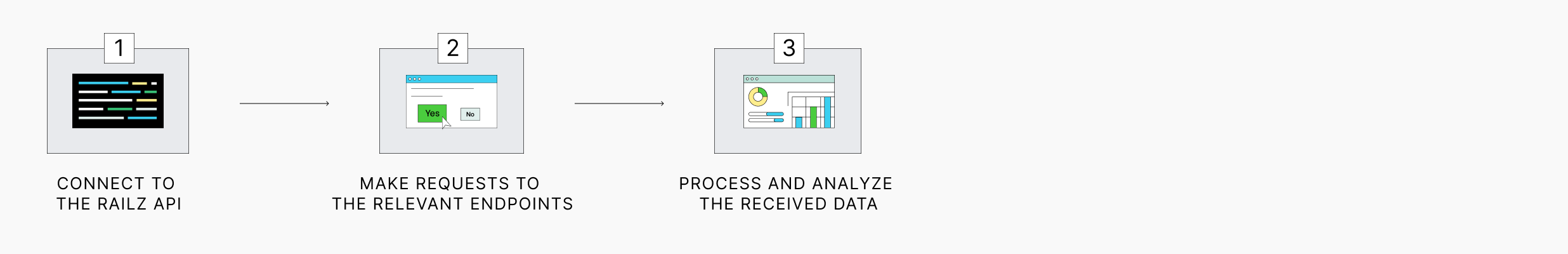

Integration & Application Logic

Integrate the Accounting Data as a Service™ API endpoints into your application logic to automate and optimize your payment reconciliation processes. By leveraging the API, you can efficiently reconcile vendor and bill information, match banking transactions with accounting data, and streamline merchant transaction reconciliation. Follow these steps as a guide to seamlessly incorporate Accounting Data as a Service™ API into your payment reconciliation workflows:

- Connect to the Accounting Data as a Service™ API and authenticate your requests.

- Make requests to the relevant endpoints to retrieve financial data, banking transactions, accounting data, and more.

- Process and analyze the received data and start streamlining the payment reconciliation process.

Customer Onboarding

Onboard your customers using Accounting Data as a Service™ Connect for a more integrated solution. These tools seamlessly integrate with your application as you onboard, service, and monitor your data. Create the best experience that suits your requirements and provides a smooth onboarding experience for your customers. It's time to onboard your first customer!

Data Analysis & Visualization

Accounting Data as a Service™ provides powerful tools for data analysis and visualization, empowering you to gain actionable insights from financial data. You have two options:

- Accounting Data as a Service™ Dashboard: Easily visualize reports and data. Utilize the intuitive interface to analyze financial information and make informed decisions.

- Reports and Visualization SDK: Leverage the Reports and Visualization SDK to create customized visualizations of financial data fetched from the Accounting Data as a Service™ API endpoints.

Expected Outcomes

By leveraging Accounting Data as a Service™ API for payment reconciliation, you can expect the following outcomes:

- Simplified integrations with a single API solution for payment reconciliation tasks.

- Empowered SMEs to perform basic payment tasks with ease, improving their financial management.

- Automated push and reconciliation of receivables and payables, reducing errors and improving accuracy.

- Improved operational efficiency through streamlined reconciliation processes.

- Enhanced overall banking experience for both financial institutions and their SMB customers.

Congratulations!

That concludes the guide on payment reconciliation using Accounting Data as a Service™ API in the financial industry. This guide aims to empower financial professionals and technical teams to automate payment reconciliation processes, improve efficiency, and enhance the overall banking experience.

Don't Hesitate to Reach out

If you require additional assistance you can:

- Reference our help centre HERE

- Or click the chat bubble in the bottom right corner of this page to start a conversation with our support team

Updated over 1 year ago